Session Replay

Fix bugs faster, simplify complex issues, and gain a deeper understanding of customer experience with visual recordings of every user session – right down to each click, scroll, and tap.

What is Session Replay?

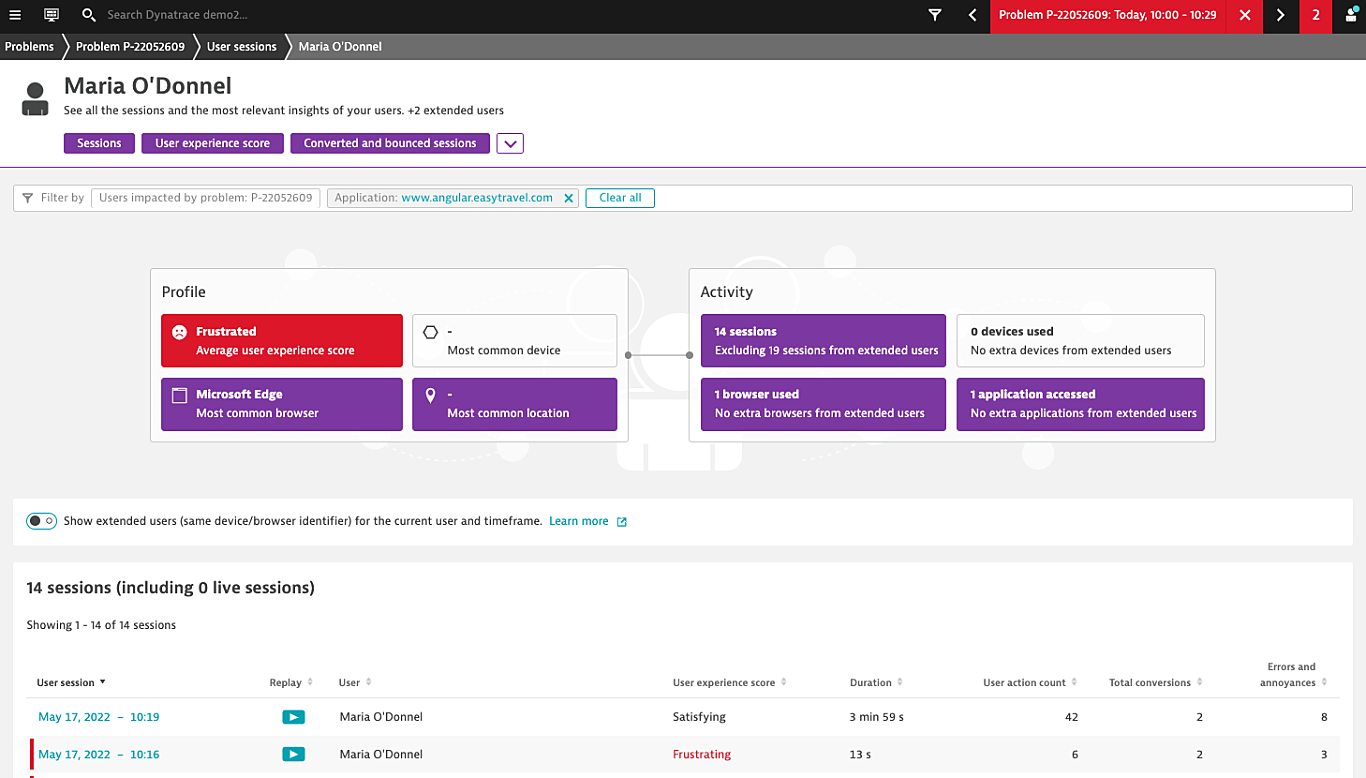

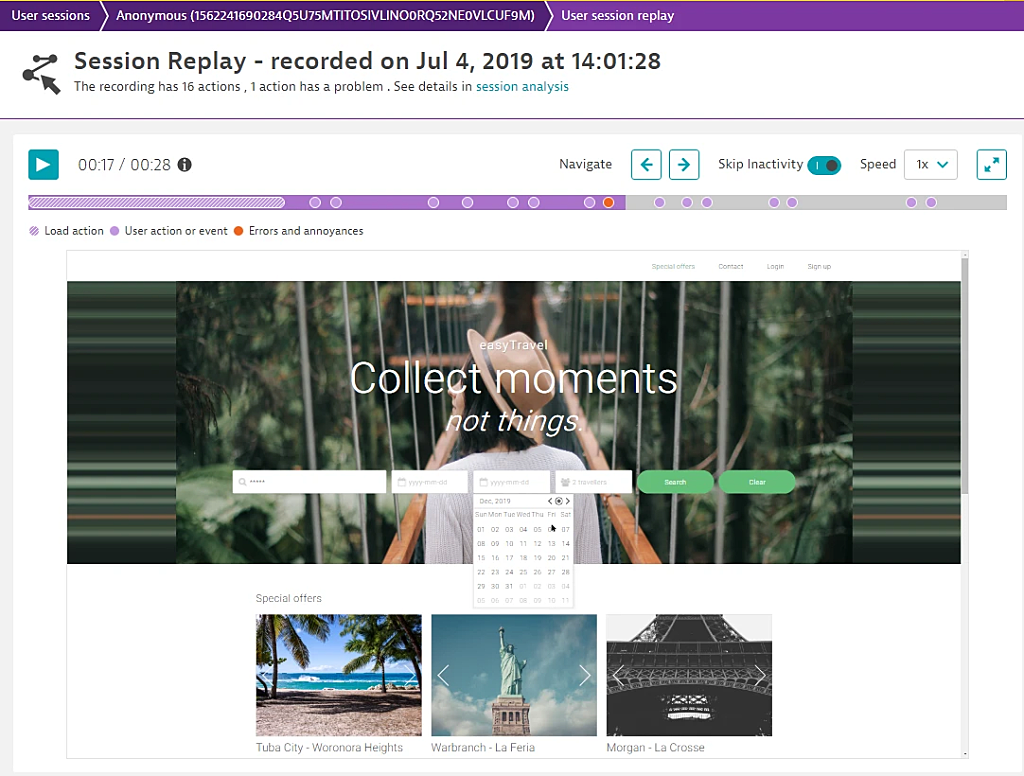

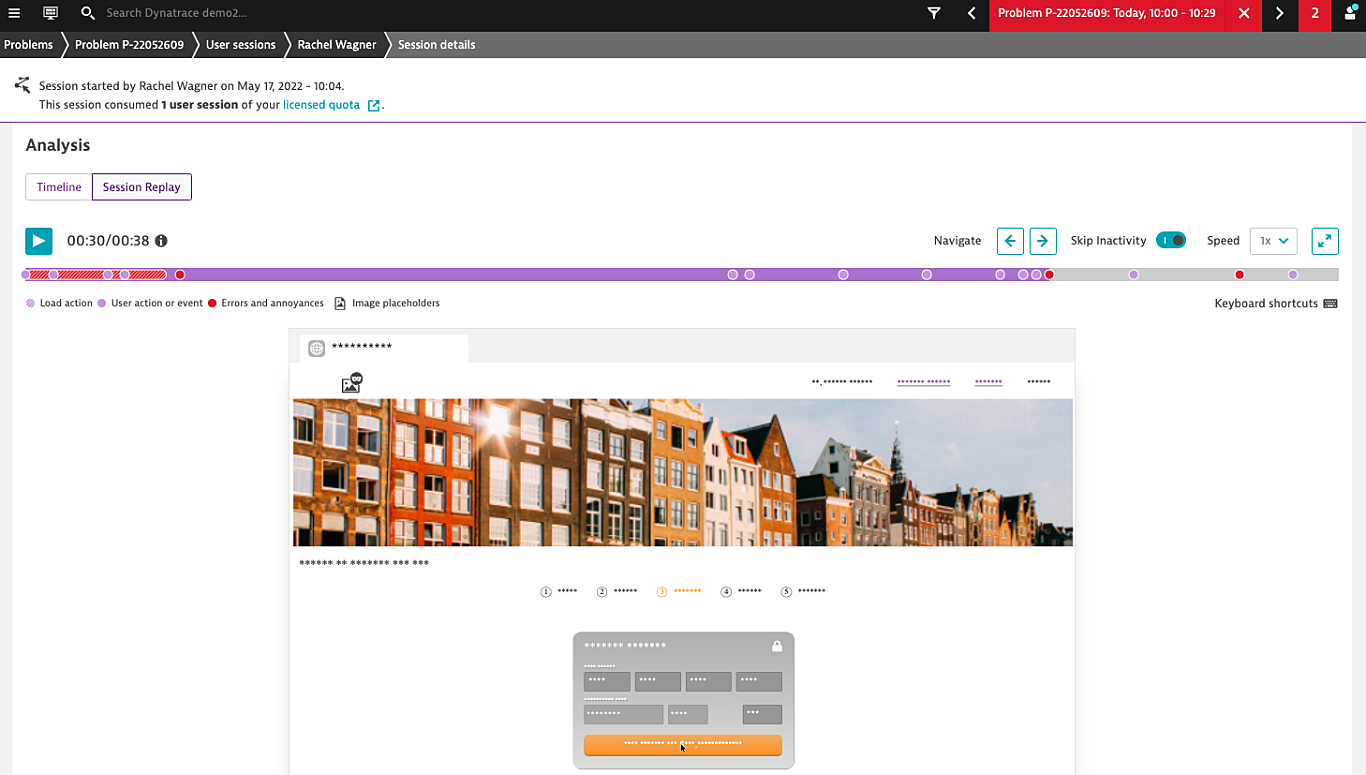

Session Replay creates anonymized, video-like recordings of users' interactions with your website or mobile app, right down to each click, scroll, and tap. You can watch their mouse movements to identify what they’re trying to do, where they’re having trouble, and what’s frustrating them (or causing them to abandon their journey altogether). By analyzing specific actions as well as your site’s responses, you'll be able to fix bugs and make improvements that increase overall user satisfaction.

Troubleshoot problems through your users’ eyes

Resolving user complaints has never been easier, with video-like replays that show exactly how they interacted with your web and mobile apps.

- Go beyond clicks and metrics with visual context into every user action to see and address points of frustration on mobile, web, and third party SaaS applications

- Easily replay recordings on-demand to view real user experience, with native support for single page apps, JavaScript frameworks, and native iOS

- Index each user session, search and retrieve what you need for fast analysis

- Seamlessly connect user sessions to backend traces for full visibility and instant answers

Improve user experience with clear-cut video evidence

Share visual recordings of real user experiences across all your teams to simplify communication and increase collaboration.

- Gain unmatched insight into user behavior with “always-on” usability testing

- Provide next-level customer service with visual playbacks to make user complaints clear and simple

- Easily address feedback from Voice of Customer and survey tools with additional video context

- Share insights across teams with on-demand recordings – no technical skills required

Keep customer privacy protected

Gaining key customer insights doesn’t mean compromising privacy.

- Easily comply with protection laws and regulations, such as GDPR and CCPA

- Make sure that no sensitive data is collected with preset masking settings, like masking all data by default, and URL exclusion

- Choose from multiple levels of data protection to configure what’s best for your organization and teams

- Give the right access to the right people with role-based access control and management zones

Dynatrace rated a G2 Leader in Session Replay

Digital Experience Monitoring with Dynatrace

-

Real User Monitoring

Gain full observability into all activity from every mobile and web user.

-

Mobile App Monitoring

Get AI-powered crash analytics and end-to-end visibility into native mobile applications.

-

Synthetic Monitoring

Simulate, measure and compare your mobile and web channels using a best-in-class network with low latency, high throughput, and high redundancy.

Expertise-based data analysis and recommendations

Business Insights combines deep Dynatrace expertise with a turnkey big data platform to go beyond application performance and unlock more value to drive business decisions. Our combination of technology, visualization, and expertise will help you communicate, interrogate and act to optimize your applications and business outcomes.

Try it free

Learn more about Session Replay

BLOG POST

Learn more about session replay and what it means for Dynatrace.

FACT SHEET

Get all the Session Replay info you need in one place.

NEWS

Stay up to date on Session Replay product enhancements, use cases, and customer stories.

WHITEPAPER

Learn how Session Replay provides best-in-class privacy

BLOG POST

Learn more about real user monitoring (RUM) and how Session Replay enhances it

Performance Clinic

Learn how to master Session Replay from Dynatrace experts